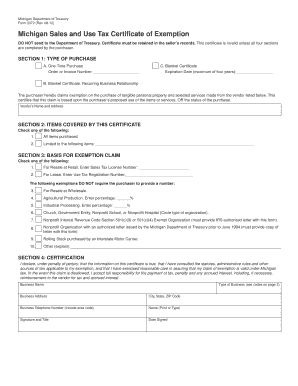

michigan use tax exemption form

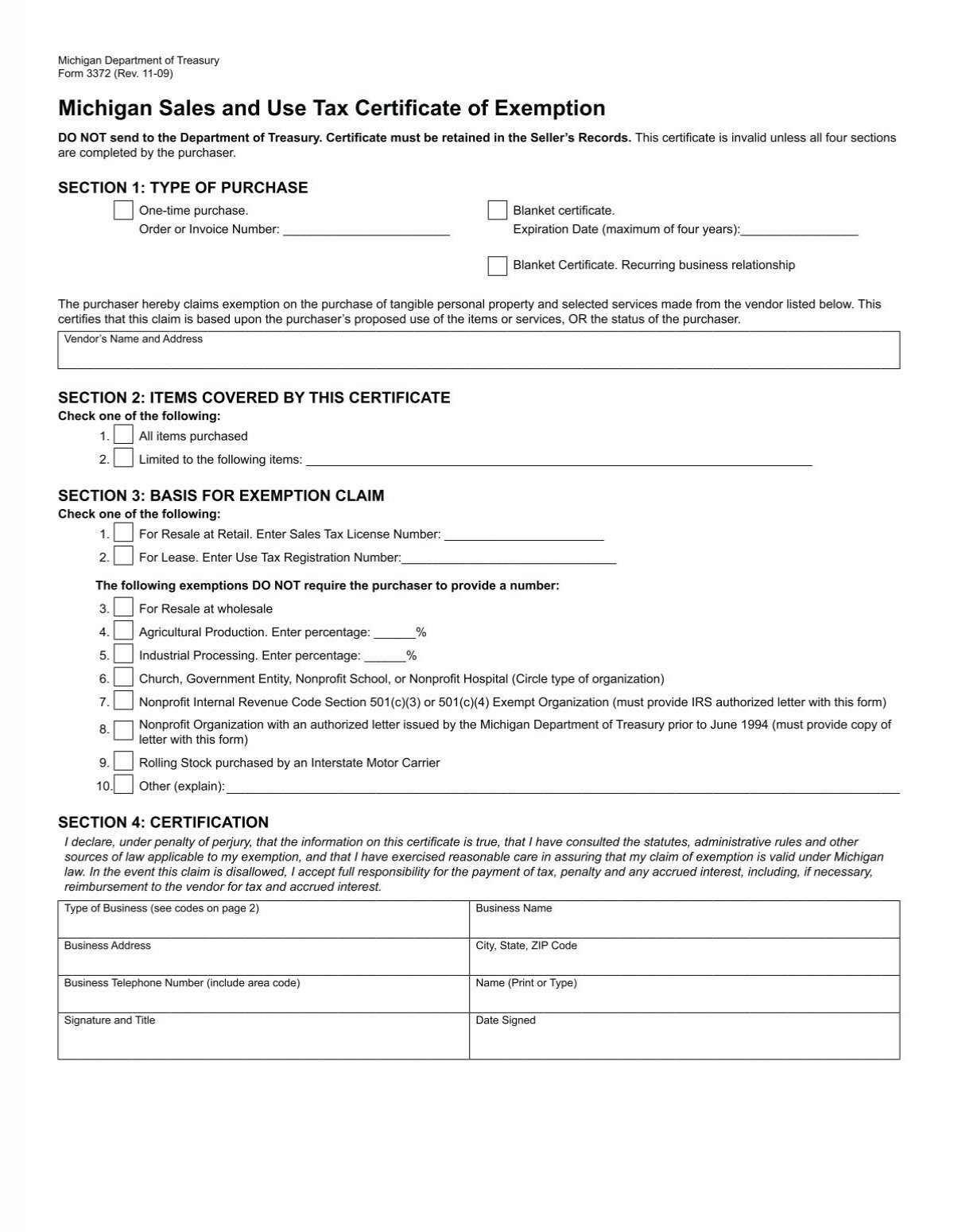

This exemption application must be completed by the buyer provided to the seller and is not valid unless the information in all four sections is complete. This box only if the property owner is qualified under the regional convention facility authority act pursuant to the Michigan Sales and Use Tax Acts MCL 20554dm and MCL 20594 z.

2022 Form 5076 Small Taxpayer Exemption Thornapple Twp

Currently there is no computation validation or verification of the information you enter and.

. Seller s Name and Address. For other Michigan sales tax exemption certificates go here. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate.

Currently there is no computation validation or verification of the information you enter and. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

TYPE OF PURCHASE One-time purchase. New State Sales Tax Registration. Michigan Sales and Use Tax Exemption Certificate.

Electronic Funds Transfer EFT Account Update. SOM - State of Michigan. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury.

All claims are subject to audit. PdfFiller allows users to edit sign fill and share all type of documents online. Vendors or sellers are required to retain the exemption certificates for a period of at least four years.

Buildings Safety Engineering and Environmental Department. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal exemption is. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Michigan is uncommon in having only one Tax exemption certificate. Do not send a copy to the IRS unless requested.

Non-qualified transactions are subject to tax statutory penalty and interest. Michigan Sales and Use Tax Contractor Eligibility Statement. Sales Tax Return for Special Events.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product.

All claims are subject to audit. Helpful Resources Sales and Use Tax Information for Remote Sellers. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

8-09 Michigan Sales and Use Tax Certiicate of Exemption DO NOT send to the Department of Treasury. Michigan Department of Treasury 3372 Rev. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2020 visit MTO to file or access the 2020 Sales Use and Withholding Taxes Annual Return fillable form.

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Many tax forms can now be completed on-line for printing and mailing.

Civil Rights Inclusion Opportunity Department. Michigan Sales and Use Tax Certificate of Exemption. Tax Exemption Certificate for Donated Motor Vehicle.

You can download a PDF of the Michigan Sales and Use Tax Certificate of Exemption Form 3372 on this page. All claims are subject to audit. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Many tax forms can now be completed on-line for printing and mailing. Department of Public Works.

A Michigan resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold. This certiicate is invalid unless all four sections are completed by the purchaser. The state of Michigan has only one form which is intended to be used when you wish to purchase tax-exempt items such as prescription medicines.

Michigan Department of Treasury Form 3372 Rev. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or 2021 Sales Use and Withholding Taxes Annual Return to access the fillable form. What are Michigan exemptions.

Most farm retail businesses simply have a location on the purchase paperwork for qualifying items requesting the producers signature. This certificate is invalid unless all four sections are completed by the purchaser. Fillable Forms Disclaimer.

OR the purchaser s exempt status. The purchasers proposed use of the property or services. This claim is based upon.

All claims are subject to audit. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. Certiicate must be retained in the Sellers Records.

Michigan Department of Treasury Form 3372 Rev. It to the contractor who will submit this form to the supplier along with Michigans Sales and Use Tax Certificate of Exemption form 3372 at the time of. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

2020 Aviation Fuel Informational Report - - Sales and Use Tax. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax.

This certificate is invalid unless all four sections are completed by the purchaser. Producers are encouraged to complete this form and give to vendors when making exempt purchases. Ad Mi Tax Exemption Form information registration support.

7-05 Michigan Sales and Use Tax Certificate of Exemption TO BE RETAINED IN THE SELLERS RECORDS - DO NOT SEND TO TREASURY. Fillable Forms Disclaimer. For more information on exemption requirements and the procedures to claim an exemption see Revenue Administrative Bulletin 2002-15.

Certificate must be retained in the Sellers Records. Forms Tax exempt forms Tax forms United States. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the seller at the time of your purchase.

The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan. The buyer must present the seller with a completed form at the time of purchase.

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan State Tax Form Fill Online Printable Fillable Blank Pdffiller

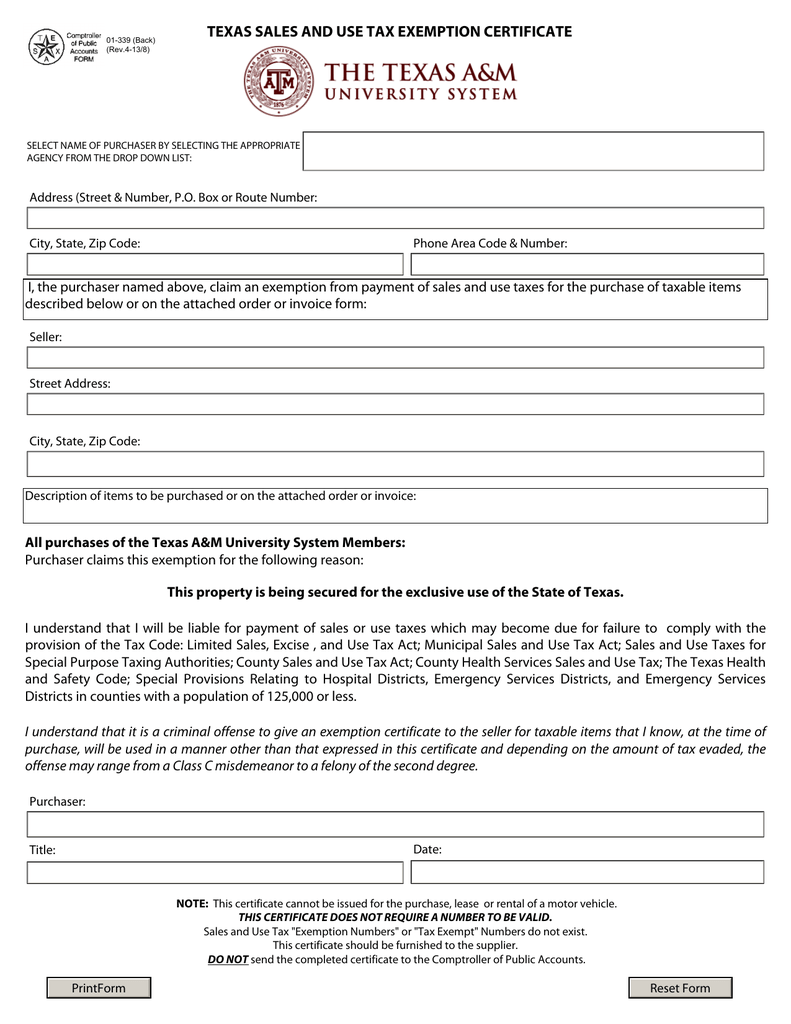

Texas Sales And Use Tax Exemption Certificate

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Mi Sales Tax Exemption Form Animart

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption